HEROMOTOCO Share Price Target: Will the Stock Break Rs 5,500 in 2025?

1. Technical Analysis:

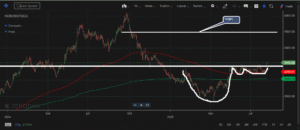

HEROMOTOCO reveals a classic cup and handle pattern, one of the most robust bullish setups in technical analysis.

-

Cup Formation: After peaking in 2024, the stock corrected sharply and then moved into a rounded, sustained bottom. This “cup” stretching from late 2024 to mid-2025 signals seller exhaustion and longer-term accumulation by strong hands.

-

Handle & Breakout: As the price approached the Rs 4,540 zone, it spent weeks consolidating into a shallow “handle,” indicating a shakeout of weak holders. The breakout attempt above this resistance with increased volume shows bulls gathering strength.

-

EMA & AVWAP: The red line is the 200 EMA, and the green line is the AVWAP from April 2023. The price structure is bullish as HEROMOTOCO trades above both moving averages, confirming positive long-term momentum. These lines now serve as strong dynamic supports (with the 200 EMA near Rs 4,250 and the AVWAP near Rs 4,050).

-

Target Projection: The height of the cup (peak ~6,200, base ~3,300) added to breakout level (4,540) points to a potential measured move above Rs 5,500—making this a realistic yet ambitious technical target for 2025.

- Bottom Line (Technical):

A clear cup and handle breakout above Rs 4,540, with price holding above the 200 EMA and AVWAP, positions HEROMOTOCO to potentially rally toward Rs 5,500 in 2025. Any weekly close above resistance on strong volume is a bullish confirmation.

2. Fundamental Analysis

About Hero MotoCorp:

Founded in 1984, Hero MotoCorp (earlier Hero Honda) is India’s leading and the world’s largest 2-wheeler manufacturer by units. After Honda’s exit in 2011, Hero has evolved—balancing its dominant commuter lineup with a determined push toward the premium and electric spaces.

Key Business Strengths

-

-

Market Leadership:

-

48% motorcycle market share, 34% two-wheeler market share (FY22).

-

Unique brands for each segment: Splendor, Passion, Glamour (bikes), Maestro, Pleasure+ (scooters), and a rising premium segment (Karizma XMR, H-D X440, MAVRICK 440).

-

Largest entry and deluxe segment player; expanding in premium and EV.

-

-

Distribution & Retail:

-

Network of 39,000+ retailers and 9,000+ global touchpoints.

-

Presence in 43 countries; ~7% revenue from abroad.

-

1,900+ charging points in 100+ Indian cities for VIDA and Ather EVs.

-

-

Production Capacity & R&D:

-

Eight manufacturing facilities; ~9.5 million unit annual capacity.

-

Two R&D centers (India, Germany), consistent new model launches, and 125 patents filed in FY22.

-

Strategic ties with Ather (increased stake to 39.7%) and Gogoro (for EV technology).

-

-

Financials (as of July 2025):

-

Market Cap: ₹90,905Cr, Price: ₹4,543, 52w High/Low: ₹6,246/3,323

-

P/E: 21.3 (below industry average), Book Value: ₹964

-

Dividend Yield: 3.63% (payout ratio 73.7%)

-

ROCE: 30.3%, ROE: 23.0%, Piotroski score: 8

-

Almost debt free (Borrowings: ₹700Cr; Reserves: ₹19,232Cr)

-

Strong and rising annual net profits: from ₹2,329Cr to ₹4,376Cr in four years

-

-

Shareholding:

-

Promoters: 34.74%

-

FIIs: 27.05%

-

DIIs: 27.77%

-

Public: 10.39%

-

-

Strategic Growth Drivers

-

Premiumization:

HEROMOTOCO is rapidly growing its premium segment, now contributing ~25% to revenue (Q3FY24), with support from Harley-Davidson collaboration and aggressive product launches. -

Electrification:

HEROMOTOCO has built the largest 2W charging infrastructure in India, is launching new EV products, and actively expanding its digital and green footprint. -

Network & Financing Power:

Expanding domestic and international reach, aided by Hero Fincorp (54% of Q4FY22 sales financed). -

Consistent Profitability:

Ten consecutive quarters of solid profits; high ROCE and ROE support further capex and innovation.

-

-

Conclusion: Will HEROMOTOCO Stock Break Rs 5,500 in 2025?

Technical momentum and long-term business fundamentals are strongly aligned.

A successful breakout above Rs 4,540, riding the support of 200 EMA and AVWAP, unlocks the Rs 5,500 target. Hero’s proven market leadership, rising premium/EV mix, robust financials, and forward-looking R&D further strengthen the case for upside.

Investors should watch for a decisive weekly close above resistance and sustained high volumes. Any breakdown below EMA/AVWAP (Rs 4,250–4,050) could lead to deeper consolidation. Overall, the road to Rs 5,500 in 2025 looks well paved for Hero MotoCorp.

1 thought on “HEROMOTOCO Share Price Target: Will the Stock Break Rs 5,500 in 2025? An In-Depth Analysis”