HDFC Life stock target 2026

HDFC Life Insurance Company Ltd remains one of India’s most formidable compounding stories in financial services, backed by a dominant parentage, deep distribution, and visible operating leverage from digital initiatives. The 2026 price target of ₹900 is grounded in a confluence of improving technicals and resilient fundamentals.

Technical Analysis

-

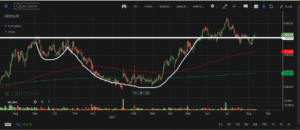

Cup-and-handle breakout above the ₹755–760 supply zone turns this region into immediate support, aligning with the recent swing base highlighted on the daily chart. Rising participation on up-days versus down-days signals accumulation and validates the breakout’s quality.

-

Momentum structure has shifted bullish: higher highs and higher lows since March, with price sustaining above key moving averages and consolidating in a tight range near prior resistance—typical of a continuation setup that often precedes the next leg higher.

-

Measured move logic from the depth of the cup projects an initial objective near ₹820–₹840; a successful follow-through keeps ₹900 in play into 2026 provided the stock holds above the breakout shelf and any pullbacks find demand near the prior resistance band.

-

Risk management map:

-

Immediate support: ₹755–₹765; deeper support: ₹710–₹720.

-

Momentum invalidation if the stock closes below the handle low on expanding volume—until then, the trend bias remains up.

-

Fundamental Analysis

Leadership and Scale

-

India’s 2nd-largest private life insurer with 15.3% private market share and 10.8% overall individual WRP share as of 9M FY25, underscoring sustained competitive strength and distribution depth.

-

Promoter group HDFC Bank holds 50.3% (Q3 FY25), anchoring cross-sell potential and access to 8,851+ branches, alongside 600 HDFC Life sales hubs, 300+ bancassurance partners, and a 2.4 lakh-strong agency network.

Product Mix and Profit Engine

-

Balanced portfolio enables margin resilience: ULIP 37%, Non-Par Savings 35%, Par 18%, Term 6%, Annuity 5% in 9M FY25, reflecting calibrated growth with protection and annuity providing ballast to profitability through cycles.

-

Operating cadence remains healthy: 9M FY25 individual APE growth 24%, VNB up 14% to ₹2,586 crore, and new business margin at 25.1%, signaling disciplined growth despite product-mix shifts.

-

Asset base strength: AUM at ~₹3.3 lakh crore (Dec 31, 2024), up 18% YoY, reinforcing fee trajectory and investment income capacity through market cycles.

-

Capital comfort: Solvency ratio at 188% in 9M FY25—well above the 150% regulatory minimum—supports growth and buffers against shocks.

Digital Levers: INSPIRE and AI

-

“INSPIRE” transformation aims to rebuild enterprise and data architecture, modernize go‑to‑market, and enhance customer journeys—expect operating efficiency gains from automated underwriting, analytics-driven cross-sell, and faster claims.

-

The company showcased tangible AI applications (personalization, service automation, risk models) through its AI Day initiative, highlighting execution depth and partner ecosystem with leading tech firms—likely to compound persistency and productivity.

Distribution Flywheel

-

A multi-pronged mix—corporate agents 27%, group 30%, direct 12%, broker 3%, agency 8%—reduces channel concentration risk and allows rapid pivoting to segments with superior unit economics.

-

Tier-2/3 markets account for 65% of revenue and are growing 2x the company rate, expanding the addressable market and supporting premium growth durability.

Watchlist: Risks to Monitor

-

Cybersecurity incident reported in Nov 2024 with ongoing investigation—management has engaged security experts; continued disclosures and remediation are key to safeguarding trust.

-

GST orders of ~₹270 crore received in Jan 2025—manageable against balance sheet strength, but outcome tracking is essential.

Why ₹900 by 2026 Is Plausible

-

Share gains and double‑digit APE growth, coupled with 25%± VNB margins and steady solvency, justify premium multiples for a sector leader.

-

INSPIRE and AI initiatives should lift operating efficiency and sales productivity, supporting earnings compounding and sustaining valuation.

-

Distribution breadth and rising penetration in underinsured markets provide multi‑year volume tailwinds that are less sensitive to short‑term cycles.

-

With the stock basing above the breakout zone and fundamentals intact, a glide path toward ₹900 into 2026 is credible, assuming trend integrity and execution continuity.