HINDUNILVR Share Price Target: Here we have divided our analysis into 02 parts:

1: Technical Analysis

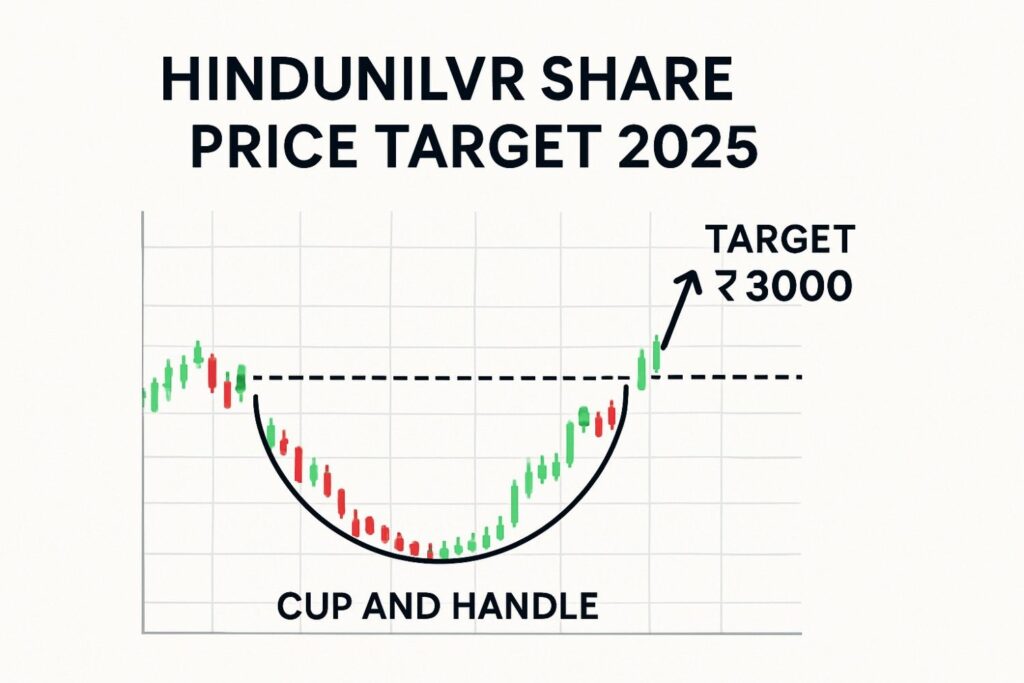

The technical chart of Hindustan Unilever Ltd (HINDUNILVR) displays a cup with handle formation, a bullish continuation pattern closely watched by traders and investors.

-

Cup & Handle Formation:

After a broad decline from its peak (~Rs 3,035), the stock based out, formed a rounded bottom, and consolidated in a pattern reminiscent of a cup. The recent smaller dip and sideways movement marks the handle, which often precedes a major breakout. -

Resistance & Breakout Levels:

-

The Rs 2,586–2,600 zone is the neckline and a key resistance.

-

Sustained price action above this can trigger a follow-through rally, with the next major target near Rs 3,000 and a measured move taking it up to Rs 3,012–3,035.

-

-

Support Zones:

-

Rs 2,400 (200 EMA, red line) and Rs 2,482 (key moving average/volume cluster) serve as strong intermediate supports.

-

A drop below these could delay breakout prospects.

-

-

Momentum & Volume:

The recent upward swing is accompanied by increased participation, suggesting renewed interest from institutional investors. -

Chart Insight:

If the stock closes firmly above resistance with volume, the pathway toward Rs 3,000 is credible, with Rs 3,012–3,035 as the cup’s projected target.

Conclusion (Technical):

HINDUNILVR Share Price Target: The pattern suggests a bullish bias. Confirmation above Rs 2,600-2,586 sets up HINDUNILVR for a possible run to Rs 3,000 in 2025, conditional on overall market sentiment and follow-through buying.

2: Fundamental Analysis

About Hindustan Unilever Ltd (HUL):

HUL is India’s top FMCG giant, operating in Home Care, Beauty & Personal Care, and Foods & Refreshment. With 50+ brands, 9 million+ retail outlets, and manufacturing strength across the country, HUL dominates multiple consumer categories.

Key Business Insights

-

Diversified Segments:

-

Home Care (36% of H1 FY25 revenue): Market leaders like Surf Excel, Rin, Vim; segment grew 32% in two years on volume.

-

Beauty & Personal Care (36%): Brands like Lakmé, Dove, Ponds; 15% revenue growth, supported by premiumization and new launches.

-

Foods & Refreshments (14%): Tea/coffee (Brooke Bond, Lipton), horlicks, Kissan, Kwality Walls, with consistent if slower growth (8%).

-

Export/Other: 3%, focused on cross-border sales and Unilever’s global network.

-

-

Brand Leadership:

-

Holds Top 2 positions in most categories and maintains stable brand power in 75% of its business lines.

-

19 brands with annual sales above Rs 1,000 Cr.

-

-

Innovation & Expansion:

-

Multiple new launches in FY24, premium product focus (25% of revenue from premium).

-

6 global R&D centers, innovation in new-age consumer categories and sustainability.

-

Nano-factories and Lighthouse status (World Economic Forum) for Dapada and Sonepat units.

-

-

Distribution Might:

-

35 hubs, 3,500+ distributors, presence in nearly all of India, 9M+ retail outlets.

-

-

Recent Strategic Moves:

-

Divested Pureit (water business) for Rs 601 Cr to sharpen core focus.

-

Financial Snapshot (as of Aug 2025)

| Metric | Value |

|---|---|

| Market Cap | ₹5,95,551 Cr |

| Current Price | ₹2,536 |

| 52W High/Low | ₹3,035/2,136 |

| P/E Ratio | 56.0 |

| Book Value | ₹210 |

| Dividend Yield | 1.70% |

| ROCE | 27.8% |

| ROE | 20.7% |

| Piotroski Score | 6.00 |

| Industry P/E | 40.9 |

| Reserves | ₹49,167 Cr |

| Borrowing | ₹1,648 Cr |

Growth & Profitability

-

Net Profit (last 5 yrs): ₹7,999Cr → ₹10,671Cr.

-

Compounded Sales/Profit Growth:

-

Sales: 5-year CAGR 10%; TTM 3%.

-

Profit: 5-year CAGR 9%; TTM 3%.

-

-

Stock Price CAGR:

-

10 years: 11%; 5 years: 3%; 1 year: -8%.

-

-

Return on Equity:

-

Last year: 21%; 10-year avg: 29%.

-

Strengths and Risks

-

Strengths:

-

Market dominance and sticky brands.

-

Healthy margins, consistent profit/dividend payout.

-

Debt-light, robust cash reserves.

-

Powerful distribution and innovation engine.

-

-

Risks:

-

Slower growth in recent years—sales & profit growth down to low-single digits.

-

High valuation (P/E 56) vs sector (P/E 40.9).

-

Increasing competition, margin pressures, and demand swings in key categories.

-

Shareholding (Jun 2025)

-

Promoter: 61.90%

-

FIIs: 10.18%

-

DIIs: 15.99%

-

Public: 11.86%

-

Government: 0.07%

Will HINDUNILVR Break Rs 3,000 in 2025?

HINDUNILVR Share Price Target : Technicals support a bullish breakout from a cup with handle, provided Rs 2,600–2,586 zone is surpassed with volume. Fundamentals remain rock-solid in terms of brand, reach, and profitability, but recent growth has slowed and valuations are premium.

A breakout to Rs 3,000 is achievable, particularly if consumer demand revives and HUL succeeds in premiumization and volume-led growth initiatives. As always, investors should monitor quarterly performance and wider FMCG sector trends.

HEROMOTOCO Analysis : see here

For more info Visit : screener.in